Insights and Strategies

I Got You Babe

In some aspects, 2021 felt like an extension of 2020. Although economies are almost two years into the recovery, the COVID-19 pandemic has continued to impact people’s lives and made some recall the 1990s movie “Groundhog Day”. The film, starring Bill Murray, tells the story of a man trapped in a time loop: he awakens every day to “I Got You Babe” playing on the radio, and lives the same events of the previous day. Just like in the movie, the same song will keep on playing in 2022 (i.e., COVID-19 uncertainty), although we expect the performance for markets across asset classes to be quite different than in 2021. In particular, we anticipate more volatility and a tougher market climate as we move beyond the early phase of the recovery. For equities, we believe the easy gains are behind us and suggest investors think long-term, diversify, and be selective. Coming out of the burrow

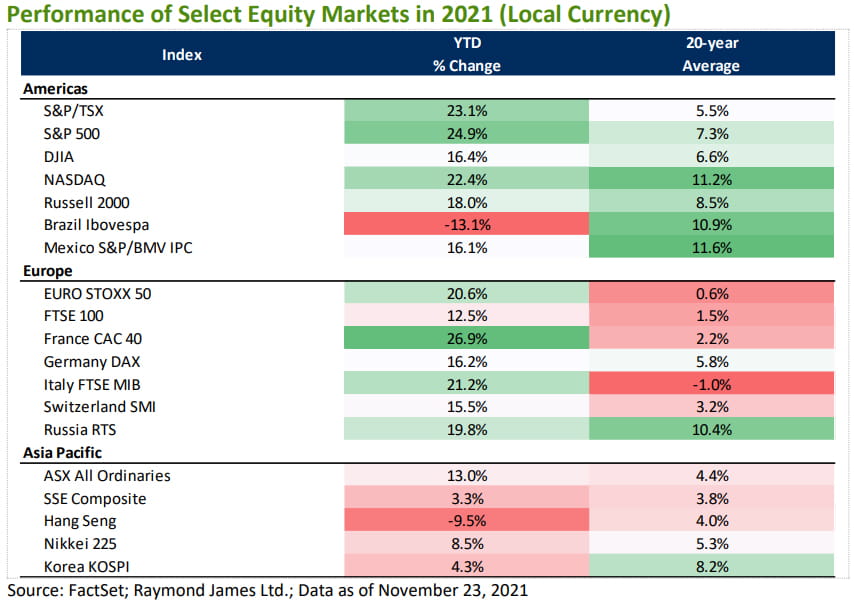

The COVID-19 pandemic caused a global recession in 2020 and has been the main driver of macroeconomic and market performance ever since. With record low interest rates/yields and +US$17 trillion in global fiscal stimulus, the economy rebounded sharply. Demand has been strong and a boon to equity markets. Most stock indices, particularly in North America and Europe, have performed well above historical returns in 2021. The exceptions are a few markets in Asia and Latin America, mainly due to idiosyncratic factors (e.g., Brazil).