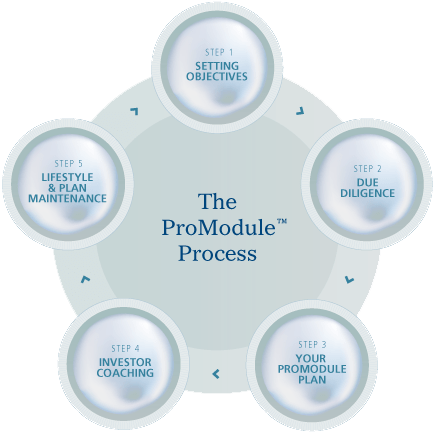

Our ProModule™ Process

Integrating Our Insights into a Step-by-Step Approach

The ProModule™ Process brings together our insights, resources and capabilities. Our objective is to build a plan that works for you because it puts your goals within reach, and because it continues to support your lifestyle over time.

SETTING OBJECTIVES

Our process starts with a clarification of your wealth and lifestyle goals. These objectives will be our focus as we sort through the details of your financial reality and build a customized plan. Many new clients aren't certain which goals are most important and what financial implications they have, so we include in this discussion our Wealth-Goal Connector, which helps you identify your goals and put them into the financial context.

Our process starts with a clarification of your wealth and lifestyle goals. These objectives will be our focus as we sort through the details of your financial reality and build a customized plan. Many new clients aren't certain which goals are most important and what financial implications they have, so we include in this discussion our Wealth-Goal Connector, which helps you identify your goals and put them into the financial context.

DUE DILIGENCE

We engage in our lengthy, hands-on due diligence process to determine the solutions that are right for you. We conduct an initial assessment of your finances and your risk tolerance as an investor, before setting out to research, strategize and design your plan. This includes having recourse to our professional network, as well as face-to-face interviews with top investment firms, portfolio managers and executives.

We engage in our lengthy, hands-on due diligence process to determine the solutions that are right for you. We conduct an initial assessment of your finances and your risk tolerance as an investor, before setting out to research, strategize and design your plan. This includes having recourse to our professional network, as well as face-to-face interviews with top investment firms, portfolio managers and executives.

YOUR PROMODULE™ PLAN

We assemble your plan according to the goals we have outlined, as well as the timing and priority of the tasks involved. Before setting it in motion, we present to you your ProModule™ Plan along with your Investment Policy Statement. The individual modules within the overview are organized by date of implementation, so that you can have a clear idea of when and how your plan will unfold.

We assemble your plan according to the goals we have outlined, as well as the timing and priority of the tasks involved. Before setting it in motion, we present to you your ProModule™ Plan along with your Investment Policy Statement. The individual modules within the overview are organized by date of implementation, so that you can have a clear idea of when and how your plan will unfold.

INVESTOR COACHING

Managing your plan is an ongoing process that requires not only monitoring, but also regular communication. To maintain the clarity we have established with your ProModule™ Plan, we communicate the investment strategies at work in your portfolio and in so doing, coach you to become a better, more confident investor as we work toward your goals.

Managing your plan is an ongoing process that requires not only monitoring, but also regular communication. To maintain the clarity we have established with your ProModule™ Plan, we communicate the investment strategies at work in your portfolio and in so doing, coach you to become a better, more confident investor as we work toward your goals.

LIFESTYLE & PLAN MAINTENANCE

Your plan is designed with your life in mind. It employs, but is not limited to, growth, performance or other wealth management strategies. This means that as we monitor your plan, we must look at how it is supporting your lifestyle over the long term. We meet with you periodically to review and update the plan according to the progress you have made.

Your plan is designed with your life in mind. It employs, but is not limited to, growth, performance or other wealth management strategies. This means that as we monitor your plan, we must look at how it is supporting your lifestyle over the long term. We meet with you periodically to review and update the plan according to the progress you have made.

"It's been my experience that more important than what your investments are, is what you do with them. The investor training aspect of my approach not only keeps my clients from worrying about their portfolios, but it also has a real bearing on the progress they make toward their goals."

Darren Coleman

Senior Vice President, Private Client Group, Portfolio Manager