Offering Cross-Border Wealth Management Solutions

One Advisory Team Two Countries

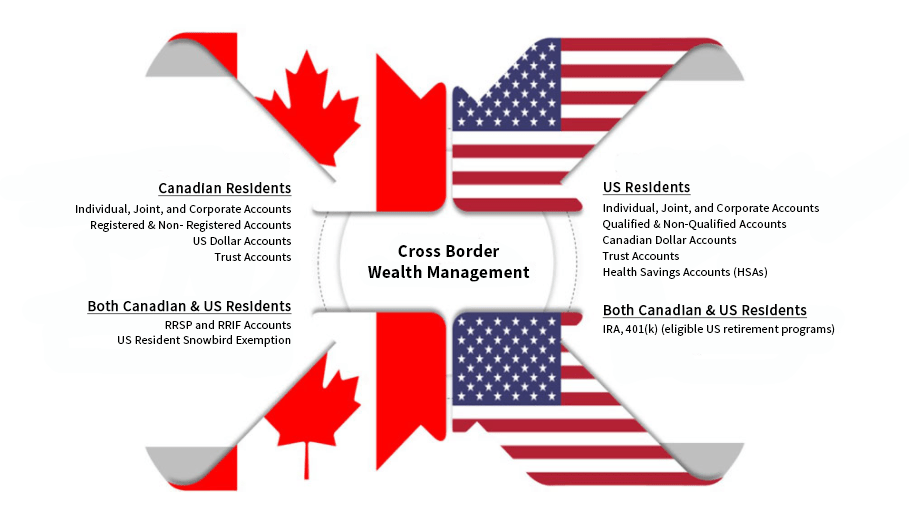

Our cross border offering is centered around providing Canadian and US investors with a single, consolidated, wealth management solution regardless of where they are currently living or working.

Canadian and US currency investments (and accounts) are available to investors on either side of the border. Uniquely licensed in both Canada and the United States, our group has developed specialized expertise in the field bringing clarity to complex cross border issues.

-

The two most common reasons why Canadians move to the United States are to try to escape the cold or to follow a new employment opportunity. When they do, they can find themselves in the unfortunate situation of being 'orphaned' by their existing Canadian based Investment Advisors as most Canadian investment advisory firms are not properly registered to do business with Canadians in the United States. The case study below illustrates how the Private Client Division of Raymond James (USA) Ltd. can help.

The background

Frank is a senior-level bank executive who built his career in Canada, but seized a growth opportunity to take a position in the United States. He planned to relocate and spend at least 10 years across the border, leaving his RRSP and other investments in Canada, where he would eventually retire.

The issue

Though the move was good for his career, it complicated his financial picture. He would have to enlist a U.S. advisor to handle his IRA, 401k, Roth IRA and non-registered savings, while keeping his Canadian advisor solely for his RRSP account.

The solution

With advisors registered across Canada who are licensed both in the U.S. and Canada, Raymond James (USA) Ltd. can help. Frank would no longer need two advisors to accomplish his goals. His Raymond James (USA) Ltd. advisor can create a disciplined investment strategy and comprehensive retirement income plan that can take his entire portfolio into consideration, regardless of where Frank ultimately ends up.

-

Many Americans living in Canada have found themselves in the unfortunate situation of being 'orphaned' by their existing U.S. based Advisors as most U.S. Broker Dealer and Investment Advisory firms are not properly registered to do business in Canada. The case study below illustrates how the Private Client Division of Raymond James (USA) Ltd. has helped solve the issue Canadian residents with U.S. retirement accounts have faced.

The background

Jim and Janis had lived in the U.S. their entire lives until they relocated to BC when they were in their 30's. Jim was a corporate executive and Janis was a homemaker. They had four children and built their lives in Canada for the next 25 years.

Jim and Janis have done a good job focusing on RRSP contributions and Jim was also fortunate while working to accumulate a significant concentrated position in a blue chip dividend paying stock in his IRA and 401k.

The issue

For the past 25 years, they were investing with two different investment advisors, one for their Canadian portfolio, and another in the U.S. for Jim's IRA and 401k. Then one day out of the blue Jim received a call from his U.S. investment advisor saying the rules had changed and he would no longer be able to service Jim's IRA and 401k. He told Jim he had 30 days to find a new advisor or they would liquidate the IRA and 401k accounts and mail him the net proceeds.

The solution

With advisors registered across Canada who are licensed both in the U.S. and Canada, Raymond James (USA) Ltd. can help. Not only would you avoid this taxable (and potentially penalized) IRA and 401k distribution, we would also be able to create a disciplined investment strategy and comprehensive retirement income plan that would take your entire portfolio into consideration.

-

With the weakness in the Canadian dollar versus the U.S. dollar, you could be in the unfortunate situation of receiving a Canadian dollar inheritance that is 15–25% less than you thought it would be. The case study below illustrates how the Private Client Division of Raymond James (USA) Ltd. can help.

The background

Samantha’s mom passed away in Canada. Her mother held a RRIF, TFSA and owned her principal residence in Canada. The entire estate, including the sale of her mom’s property, was to be settled in Canadian dollars. Once the estate settled, Samantha’s portion of her inheritance was ready to move to the U.S. where she resided; however, given the weakness in the Canadian dollar and her goal of vacationing in Canada on an annual basis, she would like to maintain the proceeds in Canadian dollars.

The issue

Since Samantha lives in the U.S., a Canadian wealth management firm is not able to set up an investment account for her, and the majority of U.S. wealth management firms only have a U.S. dollar account type, so Samantha is not able to achieve her goals of keeping the funds invested in Canadian dollars.

The Solution

With advisors registered across Canada who are licensed both in the U.S. and Canada and who also have the ability to set up multi-currency investment accounts, Raymond James (USA) Ltd. can help. Samantha would not have to make the decision to move her inheritance funds to U.S. dollars. Her Raymond James (USA) Ltd. advisor would be able to create a disciplined investment strategy in Canadian dollars, and when there is a better time or a need for U.S. dollars, Samantha’s Raymond James (USA) Ltd. advisor could handle the foreign exchange conversion.

"A series of complications arose because of our investments and tax filing obligations when my partner and I retired to Canada after careers in New York. However, the team was able to bring everything in line with a plan that also covered - and exceeded - our retirement goal."

- Caryn K. & Margaret P.

Retired

Toronto, ON and New York, NY